-

High yield has posted solid year-to-date returns, showing resilience despite macro headwinds and rates volatility.

-

Company fundamentals are starting from a position of strength, but early signs of deterioration warrant caution.

-

Yields above 9% continue to look attractive and potential short-term spread widening could present entry points.

Late-cycle dynamics, risk-on rally

Despite rising rates and slowing growth, the risk-on rally has prevailed with key high yield indices up over 5% year to date through September 30.1 Remarkably, the riskiest ratings segment (CCCs and below) has outperformed (up over 10% year to date), even in the face of recession concerns. High yield index yields are now above 9%, which has historically provided above-average subsequent long-term returns.2

On the surface, it may seem like all is well in the high yield market. But late-cycle markets are often accompanied by euphoria as risks become underappreciated by the market. As the cycle turns, companies will inevitably face challenges and earnings pressure while markets grapple with the potential of higher-for-longer rates and lingering recession fears. This leaves investors facing a conundrum as they evaluate the risk-reward trade-offs. Can high yield companies withstand a downturn? What challenges lie ahead? Yields are attractive, but spreads are near long-term averages. So, is now the right time to invest in high yield?

Solid fundamental starting point, emerging warning signs

As the economy slows, fundamental pressure and downside risks will inevitably weigh on the market. However, most high yield companies continue to display stable fundamentals. The majority of high yield companies entered the year with well-managed balance sheets, including historically low leverage, high interest coverage and sufficient liquidity. That said, warning signs are emerging.

During 2022, companies did an impressive job of maintaining margins and passing through prices. Now, 2023 and beyond is more likely to be about maintaining prices and volume. Leverage is increasing, albeit off very low levels, and interest coverage ratios are deteriorating. The potential for higher rates for longer could exacerbate these concerns as companies face higher refinancing costs. Although it is still possible that global central banks will be able to engineer soft landings, we see this as a low probability and continue to expect developed-market economies to contract modestly in 2024. While the downturn is likely to be short and shallow, companies will continue to face increasing margin pressures. Even if a recession doesnt occur, a soft landing could also present challenges as companies could face stubbornly high rates for longer. We believe many high yield companies are well-positioned to navigate a downturn, however, idiosyncratic situations are creating dispersion and selection will be key.

Increasing bifurcation, cautious on lower-quality credit

As the cycle extends, weaker companies with limited free cash flow and little room for error are most at risk. Most companies are well-positioned to fulfill debt obligations, but those riskier companies with troubled balance sheets may have difficulty accessing capital markets and refinancing upcoming maturities. Bifurcation is increasing across the high yield market. The credit outlook for BBs and Bs is generally stable, while the outlook for CCCs and below is more difficult given the challenging environment. We expect this divide to widen as economic headwinds persist.

Opportunities in higher-quality bonds

Lower-quality bonds have outperformed year to date, but we think this momentum will fade as riskier credits face more challenges. As a result, a shift to higher-quality companies can help minimize downside risk. Importantly, given the rise in yields across the ratings spectrum, investors no longer need to stretch for unnecessary risk in order to add yield potential to a portfolio. And while caution is warranted and careful security selection is key, there are still many intriguing opportunities to invest in higher-quality companies with attractive yields.

Attractive yields, higher breakeven

High yield investors are facing a valuations conundrum. After years of low rates, high yield finally offers attractive overall yields. Yet, spreads are around long-term averages and could be biased toward short-term widening.

From a yield perspective, high yield is now living up to its name with yields above 9%. In recent history, there have been very few opportunities to invest in the asset class at these levels. Historically, investing when yields were 8% have led to double-digit annualized total returns over the subsequent one, three and five years.3

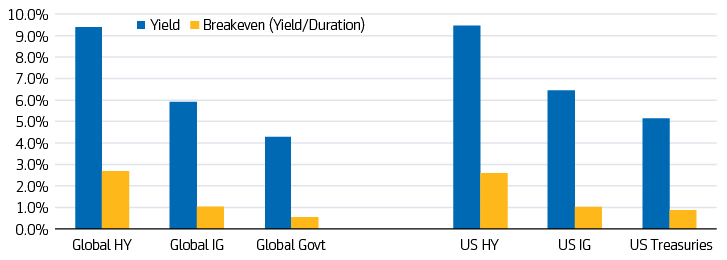

In addition, high yield can offer an attractive breakeven relative to other fixed income assets (Exhibit 1), with a higher yield per unit of duration, indicating that the yield available should more than compensate for potential rate volatility. While it can be challenging to time the market, yields above 8% to 9% can provide appealing long-term total return potential.

Exhibit 1: High yield can offer a higher breakeven (yield/duration)

Source: Bloomberg and BofA. Based on various ICE BofA indices. Breakeven reflects yield to worst divided by effective duration. As of 30 September 2023

Spread widening could present compelling entry points

Yields are attractive, but investors also assess the market in credit spread terms. Spreads are around long-term averages and not reflective of recessionary levels. After the rally witnessed so far this year, its unlikely that we will see sustained spread tightening in the near term, although tight market technicals can exert positive pressure.

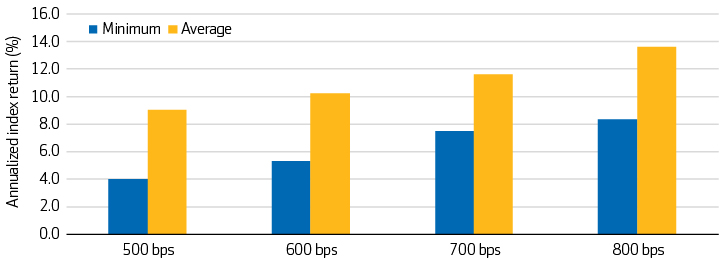

In the short term, spreads will likely be biased toward widening. After trading range-bound throughout most of the year, spreads have recently widened modestly amid macro and geopolitical volatility. Higher spread levels have started to expose some interesting buying opportunities and subsequent spread widening from here could present still more compelling entry points. Historically a starting OAS of 500 to 800 basis points has resulted in an average total return of 9% or more over the following five years (Exhibit 2). Although spreads could be biased toward widening in the short-term, we expect this could be more contained than during prior downturns given the solid fundamental starting point and higher-quality composition of the high yield market today.

Exhibit 2: Five-year forward high yield index returns based on starting OAS

Source: Aegon AM and Bloomberg. Based on monthly Bloomberg US Corporate High Yield Index data from January 31, 1994 to June 30, 2023. The 5-year returns based on the forward annualized index return for months where the starting OAS was at the level shown. Past performance is not indicative of future results. Data is provided for illustrative purposes only. All investments contain risk and may lose value. Index data is based on the Bloomberg US Corporate High Yield Index and is for illustrative purposes only. Indices do not reflect the performance of an actual investment. It is not possible to invest directly in an index, which also does not take into account trading commissions and costs.

Balancing caution and optimism to uncover opportunities

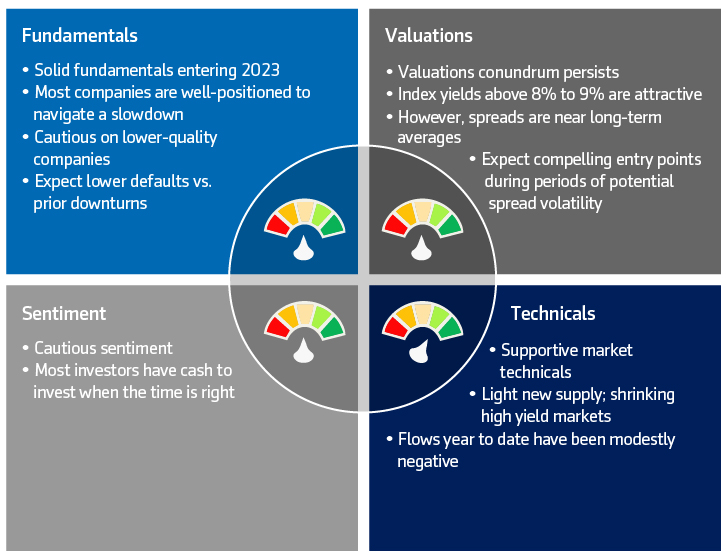

Although caution is warranted, high yield continues to offer attractive opportunities. Key factors underpinning our view include:

- Solid fundamentals: Most companies have well-managed balance sheets and fundamentals are starting from a position of strength, which should help keep distress and defaults more contained than during prior downturns.

- Attractive yields: Yields above 8% to 9% have historically provided above-average forward returns over the long term. Historically, in most environments, the starting yield to worst has been a reasonable indicator of the forward five-year return. Although each cycle is different, withcurrent yields running above 9%, high yield could generate above-average long-term returns.

- Higher-quality opportunities: Higher-quality bonds can offer attractive risk-reward characteristics, which means investors may not need to stretch out the yield curve or move down in credit quality in order to add compelling yield potential.

- Higher breakeven: Relative to many other fixed income assets, high yield can offer a higher breakeven when accounting for yield relative to duration.

- Income and carry: Income tends to drive the bulk of returns in high yield and carry can be a powerful tailwind for total returns.

- Risk-adjusted returns: The structural case for high yield persists, as the asset class has the potential to generate strong risk-adjusted returns compared to many other fixed income assets, and even equities, over the long term.

Downside risks remain, requiring a sharp focus on bottom-up research and selection. However, dislocations and market volatility should present opportunities. By balancing caution and optimism, prudent investors can capitalize on late-cycle market inefficiencies.

Aegon Asset Management high yield asset class outlook4

1ICE BofA Global High Yield Constrained and ICE BofA US High Yield indices have returned 5.53% and 5.97% year to date, respectively, as of September 30, 2023 in local currency terms. The yield to worst on the ICE BofA Global High Yield Constrained ICE BofA US High Yield indices were 9.39% and 9.47%, respectively, as of October 19, 2023.

2For illustrative purposes only. Indices do not reflect the performance of an actual investment. It is not possible to invest directly in an index, which also does not take into account trading commissions and costs. All investments contain risk and may lose value.

3Source: Aegon AM and Bloomberg.Based on monthly Bloomberg US Corporate High Yield Index data from January 1, 2008 – September 30, 2023. One-year return of 17.99% based 48 months that had starting yields of more than 8%. Three-year annualized return of 13.10% and five-year annualized return of 11.16% based on 45 months and 43 months, respectively, that had starting yields of more than 8%. Data is provided for illustrative purposes only. Indices do not reflect the performance of an actual investment. It is not possible to invest directly in an index, which also does not take into account trading commissions and costs.

4Statements concerning financial market trends are based on current market conditions which will fluctuate. All investments contain risk and may lose value. Investors should evaluate their ability to invest over the long term, especially during periods of downturn in the market. Outlook is subject to change without notice.