Key takeaways

-

Commercial mortgage credit risk in the quarters ahead will likely be cushioned by relatively low vacancy rates and modest supply pipelines.

-

While a small number of US metros will be faced with excess supply flows in the face of waning economic growth, the more pressing concern is the unsettledness in the office sector.

-

Mortgages originated at the peak of the property valuation cycle in 2022 might be a concern if the original underwriting was especially optimistic. Maturing mortgages are a challenge if the property fundamentals have weakened but extending the maturity dates should relieve some of the heat.

-

Altogether, CML credit risk prospects for 2023 are expected to vary mostly by property sector and the fundamental characteristics of individual properties.

Economic forecasters surveyed for the February 2023 Blue Chip Economic Indicators assigned a 58% probability to a recession in 2023 with most expecting it to be mild."1 Should investors in commercial mortgages worry? In this paper, we examine recent US commercial mortgage loan (CML) credit performance and the potential for excess additions to property supply that might threaten credit performance in the quarters ahead. We find very little cause for concern, except in the office sector. While new office supply is minimal, tenants continue to grapple with work-from-home uncertainty. In addition, we review the 2001 and 2008 recessions which suggest that a short mild recession, as in 2001, could have a minimal negative impact on property performance.

As 2023 gets underway, investors continue to ponder the possibility of recession in response to the upward push in interest rates that the US Federal Reserve (Fed) initiated last year to quell inflation. The Feds projections call optimistically for a soft-landing with very weak but still positive annual economic growth in 2023. That outlook could encompass the two-quarters of negative GDP growth envisioned by many private sector forecasters.1 We believe weak economic growth in 2023 will dampen demand for space throughout the four major property-type sectors in the commercial property universe, but it will take time to play out. As it does, any negative impact on the net operating income (NOI) of property owners will affect their ability to make mortgage payments. Should investors in commercial mortgages worry?

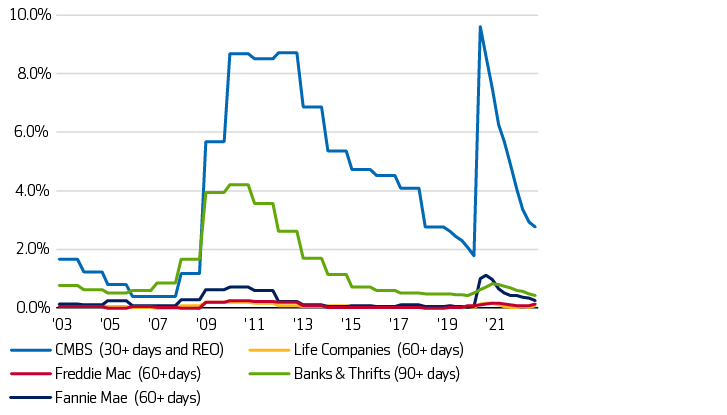

Credit metrics generally favorable through 2022

Credit performance for commercial mortgages in the later part of 2022 was very solid. As shown in exhibit 1, current delinquency rates vary by originators and property sectors. Note that life company and Freddie Mac delinquencies are so low that they are almost invisible on the chart. The variation among originators occurs largely due to different risk/return profiles for the end investors which results in different underwriting via higher or lower leverage, longer or shorter interest-only periods, and varying property type allocation, among others, all of which impact the risk of default. Overall, these readings represent recovery from the Covid recession when lodging and retail sector delinquencies reached double-digit readings particularly for mortgages in CMBS securitizations.

Exhibit 1: Commercial/multifamily mortgage delinquency rates

Source: Mortgage Bankers Association, 3Q 2022.

MBA 2022 year-end delinquency by property sector*

| Lodging | 6.1% |

| Retail | 5.4% |

| Office | 1.6% |

| Industrial | 0.3% |

| Multifamily | 0.5% |

*30 days or more. Source: Mortgageorb. January 17, 2023.

Differences in delinquency rates reflect property sector and timing

Lodging and retail sector mortgages suffered disproportionately during the Covid recession because consumers refocused their shopping online, tourist travel collapsed, and business travel dropped to a bare minimum; all to avoid Covid contagion. The pattern of credit problems within these sectors reflected the degree of impairment in NOIs versus the financial burden of the mortgage debt. Mortgages maturing during the Covid recession were also problematic if lenders were unable or unwilling to extend maturities.

The economic weakening expected for 2023 is unlikely to have a similar disproportionate focus on lodging and retail sectors which have largely recovered. The focus for a possible 2023 recession appears to be on mortgages secured by office properties. As shown in exhibit 2, office use has not recovered from the Covid recession when work-from-home became necessary and pervasive to avoid contagion.

Exhibit 2: Kastle Back to Work Barometer

Source: Kastle Back to Work Barometer. February 1, 2023.

In the aftermath of the pandemic, employers are struggling to bring staff back to their desks while accommodating some of the desire among employees for flexibility to work from home at least some of the time. As a result, office tenants are recalibrating how much space is needed for this more flexible approach to office attendance. At the same time, expectations of an economic slowdown are eroding plans for business expansion and the tech sector separately is restructuring, downsizing, and giving up its glut of office space. So far, the highest quality office space seems to be suffering the least.

With office leases being generally long term, we believe credit distress among office mortgages will play out slowly as leases expire without tenants renewing in full. The pattern of credit problems that emerges will reflect the degree of impairment in NOIs versus the financial burden of the mortgage debt. Mortgages maturing during the uncertain period ahead will also be problematic if lenders are unable or unwilling to extend maturities.

Beyond the difficulties confronting the office sector, credit risk is also increasing for mortgages originated at the peak of the property valuation cycle in 2022. By year-end 2022, property values tracked by the MSCI-RCA Commercial Property Price index were up from their pre-Covid March 2020 level by 52% for industrial, 31% for multifamily, 19% for office, and 22% for retail.2 Beyond the generalities associated with each property sector, any increase in risk will depend on the characteristics of each specific mortgage.

Parsing leverage and debt coverage through maturity

Evaluating prospects for an increase in CML risk through the quarters ahead requires examination of the degree of leverage, strength of property cash flow and debt coverage, and the timing of lease rollovers ahead. At origination, lenders will calibrate loan-to-value ratios and debt service coverage requirements that are within their risk tolerances. Beyond these calculations, lenders are well-advised to consider the vulnerability of each property to downside risks to value and cash flow over the entire term of the mortgage. This analysis requires consideration of property quality and competitiveness with its peers, the timing of tenant rollover, capacity of the market to generate competitive new supply, and the expertise of property managers. Evaluation of climate risk is also becoming important. We believe property leverage should be low enough to withstand evolving risks with a cushion for the unknowable.

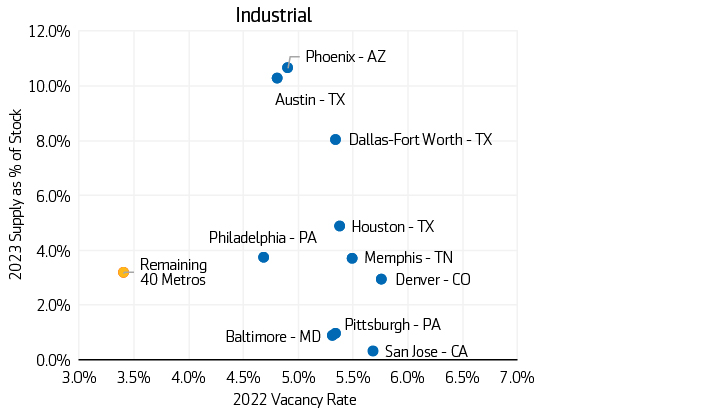

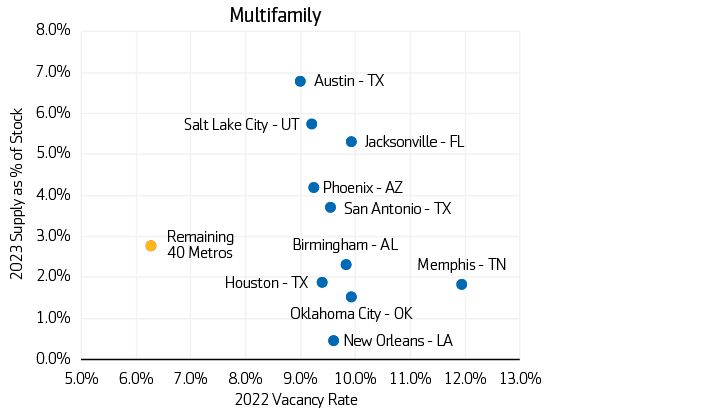

Vulnerability to recession varies widely across sectors and locales

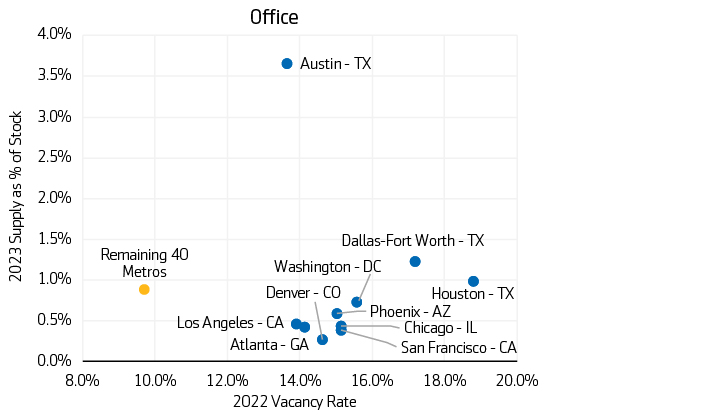

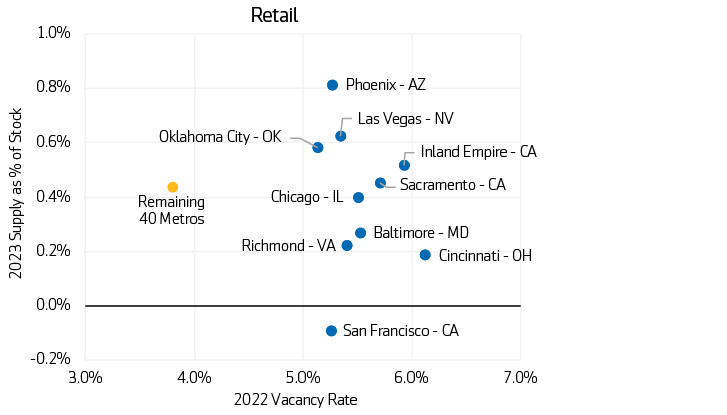

A crucial component of property-by-property credit risk evaluation is examination of current excess supply in each propertys metro area.* The most concerning source of excess supply that might threaten CML credit is newly--constructed supply that will become available as the economy weakens. For metros with low vacancy rates, new supply might be digested without disrupting credit performance. But, if vacancy rates are already high, absorption might create winners and losers. Exhibit 3 summarizes our examination of the fifty largest US metros identifying the ten with the highest year-end 2022 vacancy rates and their supply addition expected for 2023, compared to the average year-end vacancy rate and supply addition for the remaining forty metros. As shown, there is wide variation across property sectors and metros but generally supply inflows are modest for 2023. Several metro areas are worth monitoring, however, including Austins relatively booming inflow across industrial, multifamily and even office sectors. Phoenix bears monitoring as well, especially in the industrial sector.

Exhibit 3: Top 50 US metros - 2022 vacancy rate and 2023 supply as percentage of stock

Sources: CoStar Realty Information Inc. December 31, 2022.

The capacity to absorb space also differs by property sector and metro. It will reflect the vulnerability of the metro economy to weakening economic growth along with the structural forces affecting each metros business composition and demographics. Vulnerability to weakening growth might be similar to the pattern revealed in past recessions. This pattern is shown in exhibit 4 which contains the change in vacancy rates and NOI in the two years following the beginnings of the 2001 and 2008 recessions. We examine two years to account for the lag in property responses to recession. Results are calculated for the top 50 metros arranged in groups of 10 ranked by vacancy rate change.

Exhibit 4: Top 50 US metros - change in vacancy rates and NOI during 2001 and 2008 recessions

2001 Recession % Change in NOI

| Rank by Vacancy Change | Industrial | Multifamily | Office | Retail |

| Top 10 | 2.6% | 8.5% | -2.9% | 1.8% |

| Second 10 | 4.4% | 9.2% | 1.1% | 2.5% |

| Third 10 | 6.5% | 10.2% | 2.8% | 3.7% |

| Fourth 10 | 8.2% | 10.1% | -0.9% | 3.3% |

| Bottom 10 | 3.1% | 11.0% | 1.9% | 2.9% |

Recession % Change in NOI

| Rank by Vacancy Change | Industrial | Multifamily | Office | Retail |

| Top 10 | -10.1% | -12.9% | -13.8% | -11.4% |

| Second 10 | -7.9% | -12.7% | -12.2% | -8.8% |

| Third 10 | -7.7% | -12.7% | -11.0% | -8.6% |

| Fourth 10 | -7.9% | -12.5% | -10.6% | -8.9% |

| Bottom 10 | -7.4% | -12.7% | -10.6% | -8.1% |

Sources: CoStar Realty Information Inc. December 31, 2022.

The historical results are interesting in that they demonstrate that all recessions are not alike. The 2001 recession produced less than a 2% loss in real GDP over its eight months and without significant negative impact on NOIs except for office properties.3 The metros with the most severe office vacancy rate increases suffered an average of 2.9% decline in NOI. In contrast, the 2008 recession produced a loss in real GDP in excess of a 4% decline in GDP over its 18-month duration and produced severe negative impact on NOIs across all four major property sectors.4

Current expectations point to a short and mild 2023 recession more similar to the one in 2001 than in 2008. If this scenario occurs, the negative impact on NOIs might well be modest and aligned with excess supply and structural woes in the office sector.

Regulatory changes affecting originators after the great financial crisis (GFC) also provide reassurance that delinquencies will remain more modest than the GFC record. The changes enforce more conservative underwriting among the regulated originators leaving high-risk lending to non-regulated entities. Notable regulatory enhancements include the requirement that CMBS originators or another party retain a slice of the credit risk and that life company originators hold capital based on annually updated leverage and debt coverage metrics.

Summary

Economic forecasters surveyed for the February 2023 Blue Chip Economic Indicators assigned a 58% probability to a recession with most expecting it to be “mild.”1 This outlook suggests that commercial mortgage credit risk in the quarters ahead will be cushioned by the relatively low vacancy rates and modest supply pipelines reviewed in this paper. While a small number of US metros will be faced with excess supply flows in the face of waning economic growth, the more pressing concern is the unsettledness in the office sector. In addition, mortgages originated at the peak of the property valuation cycle in 2022 might also be a concern if the original underwriting was especially optimistic. Maturing mortgages are a challenge if the property fundamentals have weakened but extending the maturity dates should relieve some of the heat. Altogether, CML credit risk prospects for 2023 will vary mostly by property sector and the fundamental characteristics of individual properties. These expectations reinforce the value of portfolio diversification: by property sector, origination and maturity dates, metro area, and property fundamental characteristics.

*The focus on metro market is dictated by the metro scope of demand which is driven by metro area economic vitality. Within metros, excess supply in any individual submarket will be corrected by rent reductions which will equilibrate demand across submarkets while accounting for the value of each submarkets specific attributes. We can assume that this process works because the federal government identifies the counties to be included in each metro by assessing their economic and social integration.